In This Issue

President's Message

Featured Platinum Sponsor

In the News

Event Recaps

Upcoming Events

|

|

President's Message

Michael Casolo, JLL

As

I write this message for our first newsletter of the new year, it seems like

the start of 2015 was a long time ago in “CoreNet years.” Since January

1, our chapter has hit the ground running in true award-winning chapter

fashion.

Our

holiday party at Domenico Winery in San Carlos was a smashing success and was

well-attended by a great cross-section of our membership. The January chapter

meeting, our 15th Annual Market Forecast event, was generously

hosted by Electronic Arts and was one of the most engaging and dynamic panels

that we have had in recent years – kudos not only to our panelists (who

included Ken Rosen from the Fisher Center at U.C. Berkeley), but also to our

Programs Committee for another job well done. (In case you missed this

important program, there is a very detailed Market Forecast recap included

below.)

One of our most important orders of business for our Chapter during

this time of the year is succession planning, which has two major components:

officers and directors, and committee co-chairs. Your Board has set as a very

high priority a commitment to a transparent, inclusive and fully representative

succession process. Additionally, we have focused this year on looking two

steps ahead instead of just one. We want to promote and provide leadership

opportunities for our members. As such, we need to look not just at who is in

the candidate pool today today, but also who we can develop to populate the

pool down the road. We then need to proactively provide them with the

experience that they need to be productive Board members.

The first output of this process brought to you our nominated

slate of officers for 2015/2016: President Sandy Heistand (Advent),

EVP/President-Elect Michael Bangs (Oracle), Secretary Jamie Moore (DPR

Construction), Director-at-Large John Lucas (Juniper), and Director-at-Large

Jay Sholl (CBRE). Chris Chandlee (AT&T) will continue into the second year

of his term as treasurer, and Dick Palomba will do the same as our

administrative officer. As the soon-to-be immediate past president, I will step

into the third director-at-large position.

In the coming weeks, we will be selecting our committee

co-chairs -- the group that does the serious work for the Chapter. I

would be delinquent in my duties if I did not take this opportunity to

encourage all of you to become involved and join a committee – and to consider

becoming a Board member down the road. It is a truly rewarding experience.

(Information on how to get more involved can be found at the end of this

newsletter.)

With that I will leave you with my hopes that I will see you

at an upcoming chapter event, whether a monthly program, a Women of CoreNet

event, or a Young Leaders get-together. Here’s to a strong 2015 for CoreNet

NorCal.

Michael Casolo

|

Back to Top

|

|

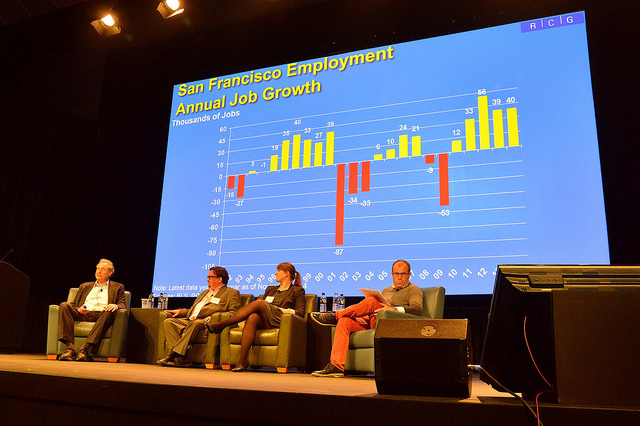

CoreNet January Chapter Meeting Recap

by Erin Carew, Instigate Marketing & Public Relations

One of the best-attended meetings every year is

our Annual Market Forecast because of the valuable information that is provided

to our members. Even if you could not make it to the meeting this year,

we have provided here a detailed recap of the important discussion, including

some of the most informative presentation slides.

On January 15, 2015, CoreNet Northern California

held its Annual Market Forecast event at Electronic Arts’ headquarters in

Redwood City. Featured speaker Ken Rosen, chairman of Rosen Consulting

Group, a real estate market research firm, and chairman of the Fisher Center

for Real Estate and Urban Economics at U.C. Berkeley, delivered an informative and entertaining

keynote address to a crowd of more than 150.

Rosen began his remarks with a macro perspective

and shared what he sees as the factors affecting the current economic

landscape. On the positive side, he identified private sector job growth,

strong auto sales, very low interest rates, global monetary easing, declining

oil and gas prices (with a possible end of OPEC) and improvement of the

for-sale housing market. He pointed out negative influences as well,

including a recession in Europe, a slowdown in emerging markets such as China,

the “Fragile Five” and Russia, the contagion effect from the oil and commodity

price plunge, geopolitical events such as ISIS in Iraq, Syria and Saudi Arabia,

as well as unrest in Ukraine, Gaza, Pakistan, Iran, North Korea, Libya,

interest rate normalization and the question of a credit and asset bubble.

Rosen noted that while the rest of the country

is experiencing choppy to moderate growth, the Bay Area is currently

experiencing a boom. He indicated that global events could cause us to go

into recession, however, be believes nothing domestic would cause that to occur

in the near future.

Regarding U.S. employment growth, Rosen stated

that we have been through the worst recession of our careers with estimated

loss from peak to trough of 8,818,000 jobs. Since February 2010, approximately

11,215,000 jobs have been created. In 2014, jobs grew at an average of

238,000 per month. “We are creating a jobs machine in the Bay Area,” said

Rosen, “Job openings have soared, and we are at full employment by anyone’s

measure.” He added, “However, Federal Reserve Chairperson Janet

Yellen is yet to reflect this in monetary policy.”

Rosen went on to give his perspective on

monetary policy and shared his predictions about when and how much the Fed will

raise short-term interest rates, often referred to as policy firming. He

criticized the quantitative easing program the Fed initiated in 2013 under

former Chairman Ben Bernanke, which consisted of buying trillions of dollars of

bonds. Rosen dismissed the program, which ended in October of last year,

as ineffective as it created few new jobs, however, it did create the

beginnings of an asset bubble.

Regarding the central bank’s decision to keep

short-term interest rates near zero, Rosen said, “We have never had these

unheard of low rates. There has been nothing like this since the Great

Depression.” He commented on the Fed’s quarterly forecast, which he

referred to as “the dots.” Published by the Federal Open Market

Committee, the forecast details members’ projections for the federal funds

rates, their key short-term policy instruments, which are released in the form

of dot plots. Rosen indicated that currently “the dots” illustrate the

committee forecasts raising short rates gradually ultimately reaching 2-½

percent by December 2015. He said, “This will be a big change from where

we are now but is still low for interest rates.” He pointed out that the

biggest challenge would be rates normalizing and said that he believes much

would take place over the next three years. He added, “Interest rates in

places like Europe and Japan are too low. That’s why our rates are not going

up.” Rosen said he thinks it is likely we will see a “forward curve” with

the ten-year bond going to 3 percent by the end of 2015 and to 4.5 percent by

2019. He commented that we have a trillion dollars less in residential

debt and that he thinks money is too tight, pointing out that even many

well-qualified buyers are unable to qualify for a mortgage.

Rosen commented on inflation and indicated it is

contained for the moment. He said that many experts have expressed

concern that the quantitative easing program would devalue the dollar and drive

up inflation. However the opposite seems to have occurred. Rosen said, “I

think oil and commodity deflation is a good thing. We don’t have to have

wage increases because costs are down.” He added, “I can’t believe what I

hear out of the central bank regarding deflation.”

Another key component to the economic landscape

Rosen addressed is that U.S. oil production has soared. He expressed that

U.S. has begun importing considerably less and has actually started to export

oil. He said, “I think the Saudis are making a huge mistake by refraining

from cutting production.” He added that he believes gas, natural

gas and electricity rates will drop and that it will have a negative effect for

places like Russia, Texas and the Middle East.

Rosen gave an overview of the economic outlook

for 2014-15 and characterized it as moderate to choppy recovery at 65 percent.

In terms of economic growth, he predicts upward movement in GDP of 2.8

percent.

Relative to employment, he forecasts the

unemployment rate decline from the current rate of 5.8 to 5.3 percent during

the next year. He also believes that we will see 1.9 percent growth in

employment with 2.6 million jobs created. He sees the S&P 500 at 2,189 and

the Dow Jones Industrial Average at 18,921. (Please see Rosen’s Economic Outlook 2014-15 slide for a complete overview.)

Here in the Bay Area, Rosen believes we will

continue to be top on the list of regions with strong employment growth and

will experience double the national average. He joked that he has received job

offers that would require him to move to Philadelphia. He said, “They hit

their employment peak in 1790, so I declined.” He commented that he

thinks Washington D.C. is unattractive from a real estate perspective with

government agencies and contractors shrinking. He believes all cities

with a strong tech presence will remain on near the top of the list in 2015 in

terms of growth, and cities with a concentration of energy companies place high

as well. However cities with heavy energy employment will be at the

bottom of the list next year.

He went over midpoint pricing by property sector

and provided average cap rates and IRRs and compared today’s averages to those

experienced at the peak in 2007. For gateway office product, he showed

2007 cap rates of 5.25 percent and IRRs of 7.40 percent compared to 2014 cap

rates at 5.00 percent and IRRs at 6.25 percent. For suburban office, he

showed 2007 cap rates at 6.25 percent and IRRs at 8.40 percent and 2014 cap

rates at 6.50 percent and IRRs at 7.50 percent. For gateway industrial

product, he showed 2007 cap rates at 5.15 percent and IRRs at 7.25 percent and

2014 cap rates at 5.00 percent and IRRs at 6.25 percent. (Please see the slides titled Midpoint Pricing by Property Sector for a complete overview).

In terms of where we are in the cycle in San Francisco,

Rosen opined that multifamily is furthest along. The office market shows

more building; however, it is relatively tame in terms of new construction.

Vacancy rates are, of course, down and rents are up. 40,000 jobs

were created in the city in 2014, and there is a good number of new office

buildings under construction. He believes Silicon Valley has more staying

power than in past cycles and a little toppiness in stocks is unlikely to cause

a collapse. He pointed out that a great deal more office space is being

built, vacancy rates are down, and rents are up. He indicated San

Francisco would bump up against Prop M soon, which will mean more spillover to

Silicon Valley and the East Bay.

Rosen ended his remarks by saying, “Something

could upset the capital markets. REITS could drop 15-20 percent. I

recommend monetizing core assets or refinancing with an assumable mortgage or

doing a like-kind exchange.”

He provided these investment implications:

Core Real Estate:

- Buy

high quality REITS on a substantial dip (15-20 percent).

- Buy

office, medical office, industrial, apartments, senior housing data

centers and retail at 5 percent - 7 percent above cap rates, 80 percent

replacement costs or below.

- Monetize

mature core assets if cap rate is below 4 percent by sale of like-kind

trade or refinance.

- Lock

in low debt costs with assumable debt.

- Short

long-term treasuries.

- Short

China high-end residential real estate.

- Short Euro.

Value Add:

- Debt

for traditional assets.

- Buy

vacancy in strategic markets.

- Reposition

assets for upgrade/use.

- Buy

distressed assets from European lenders.

- Development

deals.

- Apartments.

Opportunistic:

- Single

family land/housing.

- Select

office and industrial development.

- Grocery-anchored retail development.

Rosen then participated in a lively panel

moderated by Joe Hamilton, executive managing director at Newmark Cornish &

Carey. Panelists included Amber Schiada, vice president and director of

research for JLL’s Northern California and Rocky Mountain regions, Garrick Brown,

vice president of research, western states, for DTZ, and Hilary Perchard, vice

president of business development at Sky Ventures.

Please click here to find Schiada and Brown’s presentations.

CoreNet CRE Awards Recipients In The News

CoreNet NorCal's 2014 Corporate Real Estate Award winners, Antonia Cardone, of DTZ and Curt Wilhelm, of Electronic Arts, were featured in an article in the Registry. Take a look here:

|